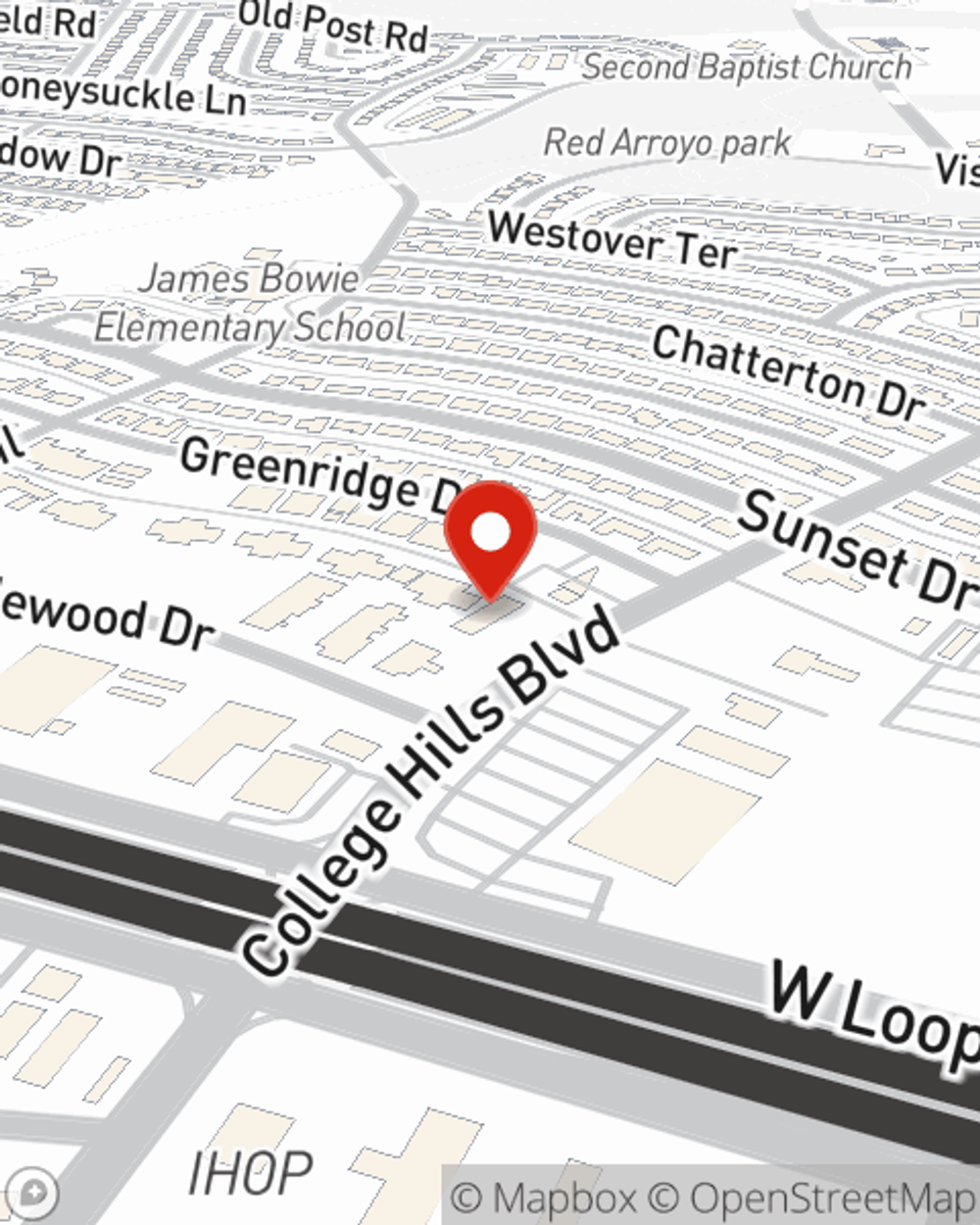

Business Insurance in and around San Angelo

Looking for small business insurance coverage?

No funny business here

Help Protect Your Business With State Farm.

When experiencing the challenges of small business ownership, let State Farm do what they do well and help provide quality insurance for your business. Your policy can include options such as extra liability coverage, errors and omissions liability, and worker's compensation for your employees.

Looking for small business insurance coverage?

No funny business here

Surprisingly Great Insurance

When you've put so much personal interest in a small business like yours, whether it's a beauty salon, a dance school, or a book store, having the right coverage for you is important. As a business owner, as well, State Farm agent Tim Smith understands and is happy to offer customizable insurance options to fit what you need.

Contact agent Tim Smith to review your small business coverage options today.

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Tim Smith

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.